How to file TDS on the Sale of Property

Buyer is liable to deduct and pay taxes. Section 194IA deals with the requirement of TDS deduction by the buyer at the time of purchase of the property.

Requirements of section 194IA

From 1 June 2013, when a buyer buys immovable property (i.e. a building or part of a building or any land other than agricultural land) costing more than Rs 50 lakhs, he has to deduct tax at source (TDS) when he pays the seller. This has been laid out in Section 194-IA of the Income Tax Act.

The buyer has to deduct TDS at 1% of the total sale consideration. Here, the buyer is required to deduct TDS, not the seller

No TDS is required to be deducted if sale consideration is less than Rs 50 lakhs.

The buyer of any immovable property need not obtain a TAN (Tax Deduction Account Number) for making payment of the TDS on immovable property. You can make the payment using your PAN.

For the purpose of making payment of TDS on immovable property, the buyer has to obtain the PAN of the seller, else TDS is deducted at 20%. PAN of the buyer is also mandatory.

The TDS on the immovable property has to be paid using Form 26QB within 30 days from the end of the month in which TDS was deducted.

After depositing TDS to the government, the buyer is required to furnish the TDS certificate in form 16B to the seller. This is available around 10-15 days after depositing the TDS. The buyer is required to obtain Form 16B and issues the form to the seller. You can check the procedure to generate and download Form16B from TRACES here.

Notice for non-filing Form 26QB

The income tax department receives an Annual Information Return (AIR) from the registrar/sub-registrar office regarding the purchase and sale of property regularly. From this report, the department can figure out if you have made a property transaction exceeding Rs.50 lakh.

If the buyer has not deducted tax at source at 1% (or 0.75%) of the transaction amount or not filed TDS within the specified time, the IT department will send a notice to the buyer.

Steps to pay TDS through challan 26QB and to obtain Form 16

The steps to pay TDS through challan 26QB and to obtain Form 16B (for the seller) are as follows:

Step 1:

Payment through Challan 26QB (Online and Offline)

- Log on to tin.nsdl.com. Select ‘Services’ from the tab and click on ‘e-payment-Pay taxes online’. A new window with different challans will open as below:

- Click on the proceed button on the tab -TDS on property (Form 26QB) as highlighted above. A new screen will appear as below:

- Select the code 0020 if you are a corporate payer and 0021 if you are a non-corporate payer. Details like Financial year, assessment year, type of payment, will be auto-populated.

- Fill in other necessary details in all other tabs like – resident/non-resident, PAN of the buyer, PAN of the seller, full address of transferee as well as transferor, complete address of the property, the amount paid in figures and words, tax amount to be deposited etc.

- Once you fill in all the necessary details, the last tab is ‘payment info’. There are 2 modes of payment at the bottom of the page: e-tax payment immediately (through net banking facility) and e-tax payment on the subsequent date (e-payment of taxes by visiting any of the Bank branches). Choose the one which you prefer and click on ‘Proceed’.

- If you choose net banking, you will be able to login into your bank and pay online. After you have paid, the bank lets you print Challan 280 with a tick on 800 (i.e. payment of TDS on sale of the property). Print this out and keep it safe.

- If you cannot pay online, an online receipt for Form 26QB with a unique Acknowledgment Number is generated for you. This is valid for 10 days after generation. You can take this to one of the authorized banks along with your cheque. The bank will proceed with the online payment and generate your challan.

Step 2:

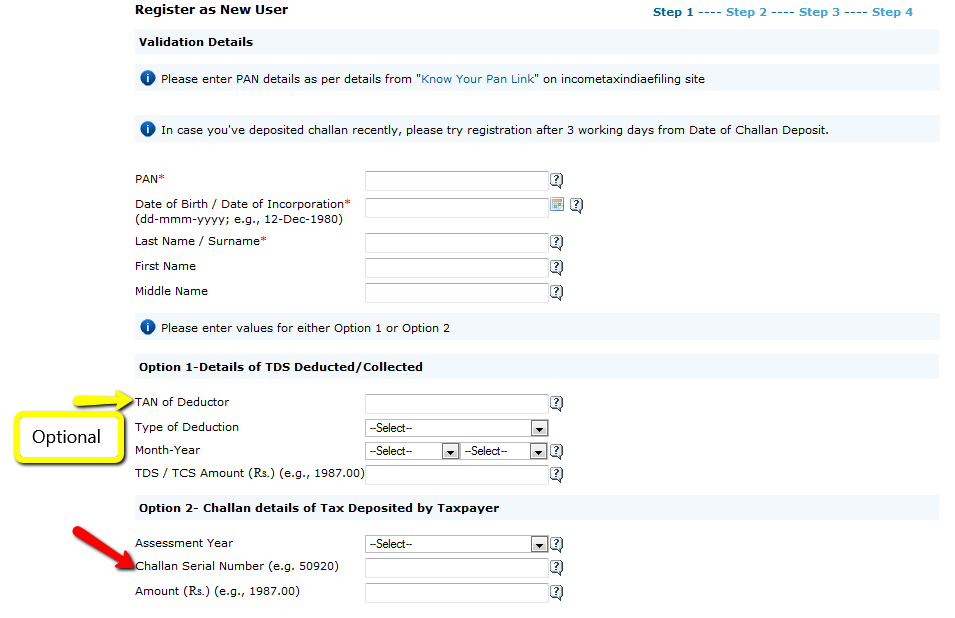

Register in TRACES

- If you are a first-time user, register on TRACES as a Tax Payer with your PAN Card Number and the Challan number registered during payment.

- Once you register, you will be able to obtain approved Form 16B (TDS certificate) and you can issue this Form to the Seller.

- Check your Form 26AS seven days after payment. You will see that your payment is reflected under “Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA) [For Buyer of Property]”.

- Part F gives you details such as TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgement number (which is the same as the one on your Form 26QB), date of deposit and TDS deposited.

Step 3:

Download your Form 16B

- After your payment in Form 26AS has been reflected, log in to TRACES. Go to the Download tab at the tab and click on “Form-16B (for the buyer)”.

- To finish this process, fill PAN of the seller and acknowledgement number details pertaining to the property transaction and click on “Proceed”.

- Verify all the details once and click on “Submit a request”.

- After a few hours, your request will be processed. Click on the Downloads tab and select Requested Downloads from the drop-down menu.

- You should be able to see that the status of your Form 16B download request is ‘available‘.

- If the status says ‘submitted‘ wait for a few hours more before repeating the last step.

- Download the ‘.zip file’. The password to open the ‘.zip file’ is the date of birth of the deductor (the format is DDMMYYYY). Your form will be available inside the .zip file as a pdf. Print this out.

Source: Online.

Further, We are also professional real estate consultant having experience of more than decade & half and can assist in entire process related to PROPERTY IN INDIA and can be a complete one stop solution of above discussed various procedures and even assist in getting following services with our collaboration with very experienced legal advisers to conclude any such transaction smoothly.

OUR BROKERING SERVICES:

Real Estate Brokering and consulting services (Buy/Sell & Lease High ticket Properties in Pune, Panchgani, Mahabaleshwer, Lonavala, Mumbai & Goa cities of India.)

Residential includes Pune Properties - Pune Property, Flats in Pune, Residential Properties Pune, Pune Properties – Find Flats in Pune, Pune Property,Properties in Pune,

Buy 1 2 3 4 5 bhk Luxury Flats, Apartments, penthouses, Bungalows & villas in Pune, New Residential Plot and Property & Real Estate Projects Ready & under construction Residential Projects in pune. Ready & under construction Residential Projects in mumbai.

Commercial properties include Pune office spaces find sale, Buy, purchase, Pune co-working space on lease, Rent pune office for sale, pune shop for sale, pune showroom for sale, pune shop for rent, pune showroom for rent, Room Hotel for rent, sale, buy, purchase, Restaurant veg, non veg Restaurant for rent sale buy purchase, land plot sale purchase buy. hospital rent lease buy purchase sale, school rent lease buy purchase sale, full building rent lease buy purchase sale.

UNDER-CONSTRUCTION PROJECTS

ASSITANCE IN PURCHASING UNDER-CONSTRUCTION RESIDENTIAL AND COMMERCIAL PROJECTS IN MUMBAI,PUNE, DELHI, NOIDA & OTHER MAJOR CITIES OF INDIA.

it requires extensive research and experience to choose best available option at the given time as opportunity always keep changing. in this case, we can assist prospective buyer in 2 ways:

Option 1) Pure consultancy on fixed fee basis: in this way, we will assist buyer to find best project and property as per his preferences & budget as buyer may already reached to builder & negotiating so we can not be paid by builder so in this case fixed fee will be charged to buyer in advance before giving the consultancy then buyer can directly approach to builder to finalize the property.

Option 2) We involved as a Brokering company: in this way, prospective buyer will visit through us to each project and we will be registered reprsentative with builder for buyer so in this case, buyer has to pay nothing for our same consultancy services which we were giving in above option 1, even we will refund fee which we receive from buyer for option 1.

ADDITIONAL CONSULTANCY SERVICES:

- PREPARING REPORT OF ALL RESIDENTIAL / COMMERCIAL PROJECTS IN SPECIFIC LOCATION OF MUMBAI OR PUNE CITY & ADVISING/ASSISTING INDEPANDENTLY TO PURCHASE BEST PROJECT FOR ENDUSE OR INVESTMENT.

- helping missing property documents index2, purchase/sale agreements in PUNE city only.

- PAN card for any NRI / PIO without visiting India,

- Assistance in reducing TDS on sale of property legally (ENTIRE INDIA)

- Will & GIFT DEED (Mumbai, Pune & other major cities of Maharashtra state)

hope able to explain our point of view, still any query, please contact anytime on given contact number for detailed Discussion, cell no./whatsapp # +91-9822052388 / +91-7498829332, Email: deepaksundrani@thegururalty.com.

There are many Advantages & Benefits to hire professional consultant which can be experienced only after hiring right person.

Rest assuring here that we work very ethically, honestly and professionally and for us, our client interest is utmost and foremost then anything else. We have already successfully assisted many NRI’s, EXPATS INVESTORS & LOCALITIES to purchase property in both Mumbai & Pune cities as per their requirements & preferences and most of them are with us to manage their properties through us only so one can judge the level of trust & integrity we have in our work & services.

wishing everyone good health and happyness.

Warm Regards,

Deepak Sundrani

Thanks for sharing this blog that is very helpful for those who want to invest in properties. buy apartments in golf links delhi

ReplyDeleteHi Dear

ReplyDeleteLooks Great Blog, & amazing fully Information for us.

The suncity Vatsal Valley provides unparalleled accessibility to local transportation, including convenient access to the metro station, bus station, roads, and airport. Suncity Vatsal Valley gurgaon offers well-maintained 2bhk and 3bhk Low Rise Floors at an economical price.

Great Blog very informational for everyone those are looking for property management.

ReplyDeleteThanks for sharing with us.

AMPM Properties

This Post is very useful for us. You can buy Apex Aura Best Apartment in Sector-1 Noida Extension.

ReplyDeleteInformative post...

ReplyDeleteDo checkout these residential villas at Coimbatore,nilgiris & anaikatti at affordable price..

Villas in Coimbatore, Nilgiris, Anaikatti

Villas in Idigarai, Thudiyalur

Villas in Dhaliyur, Vadavalli

Villas in Kovaipudur

Villas in Saravanampatti

Villas in Kalapatti

Nice Blog...!! Thank you for sharing this information.,

ReplyDeleteSumadhura Olympus

SAS Crown

Ambience Courtyard

This blog is very useful for us. ApartmentOnRent.com, are ready to help you find the best and the cheap flat, as per your demands, as we deal with all types of residential property in Noida. All facilities available like, Hospital, School, Mall Play Ground, Cctv, Gym. 2BHK, 3BHK, And 4BHK luxury apartment on rent in Noida.

ReplyDeleteHi, Nice Blog!!

ReplyDeleteThanks For Sharing

Do you need the best noida office space for your business or for investment? Then choose Grandthum, a commercial project by Bhutani infra that has office spaces, retail spaces, and serviced apartments.

This is a particularly illuminating blog, your perspective, perceptions and thoughts are astonishing and direct. I would love to read more content like this. You have worked effectively. I also have info about Real estate that is an imperishable asset, ever increasing in value. ATS Kingston Heath

ReplyDeleteATS Pristine Phase-2

ATS Pious Hideaways

ATS Le Grandiose

ATS Picturesque Reprieves

ATS Pristine Golf Villas

ATS Marigold Gurugram

ATS Grandstand Gurgaon

The details on this blog are very impressive. I also have info about

ReplyDeleteATS Kingston Heath Noida

Birla Niyaara Worli Mumbai

DLF One Midtown Delhi

Real estate that is an imperishable asset, ever increasing in value.

This blog is very useful for us. You can buy Saya Piazza new commercial Retail Shops in Noida Sector 131.

ReplyDeleteThank you for sharing such a good informative post. Office Space for Rent in Noida Extension is the good choice because of the well developed and newly constructed building, affordable rentals, and good connectivity to Noida.

ReplyDeleteNice blog and high quality article.

ReplyDeletenuvi update

garmin map update problem

nuvi map update

garmin nuvi gps update

nuvi update problems

how to update garmin gps maps

garmin gps update cost

garmin nuvi map update

nuvi update not working

garmin gps update

Many thanks, in this article, work has been done to give very important information related to real estate, property selling, Rati, which is quite useful.

ReplyDeleteI am Shuttering plywood manufacture yamunanagar , I am very much inspired by this blog.