How to file TDS on the Sale of Property

From June 1st 2013, when a buyer buys immovable property (i.e. a building or part of a building or any land other than agricultural land) costing more than Rs 50lakhs, he has to deduct TDS when he pays the seller. This has been laid out in Section 194-IA of the Income Tax Act.

Here are the requirements of this section:

- The buyer has to deduct TDS at 1% of the total sale consideration. Note that the buyer is required to deduct TDS, not the seller.

- No TDS is deducted if sale consideration is less than Rs 50lakhs. If installments are being paid TDS has to be deducted on each installment.

- Tax is to be paid on the entire sale amount. For example, if you have bought a house at Rs 55lakh, you have to pay tax on Rs 55lakh and not on Rs 5lakh (i.e. Rs 55lakh – Rs 50lakh). This is applicable even when there is more than 1 buyer or seller.

- If you are the buyer, you do not need to obtain a TAN (Tax Deduction Account Number) number.

- If you are the seller, you have to provide your PAN or else TDS is deducted at 20%. PAN of the buyer is also mandatory. TDS is deducted at the time of payment or at the time of giving credit to the seller, whichever is earlier.

- This TDS has to be deposited along with Form 26QB within 7 days from the end of the month in which TDS was deducted.

- After depositing TDS to the government, the buyer is required to furnish the TDS certificate to the seller. This is available around 10-15 days after depositing the TDS.

- Thus for paying TDS the seller is required to obtain Form 16B and the buyer is required to obtain Form 26QB.

The steps to pay TDS and to obtain Form 16B (for the seller) or Form 26QB (for the buyer) are as follows:

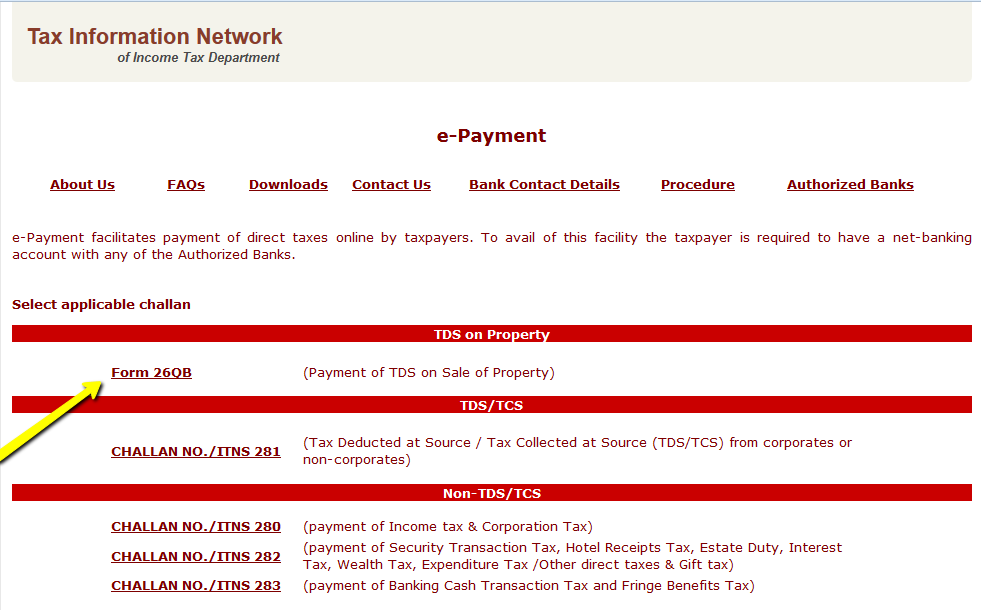

Step 1: Payment through Challan 26QB (Online and Offline)

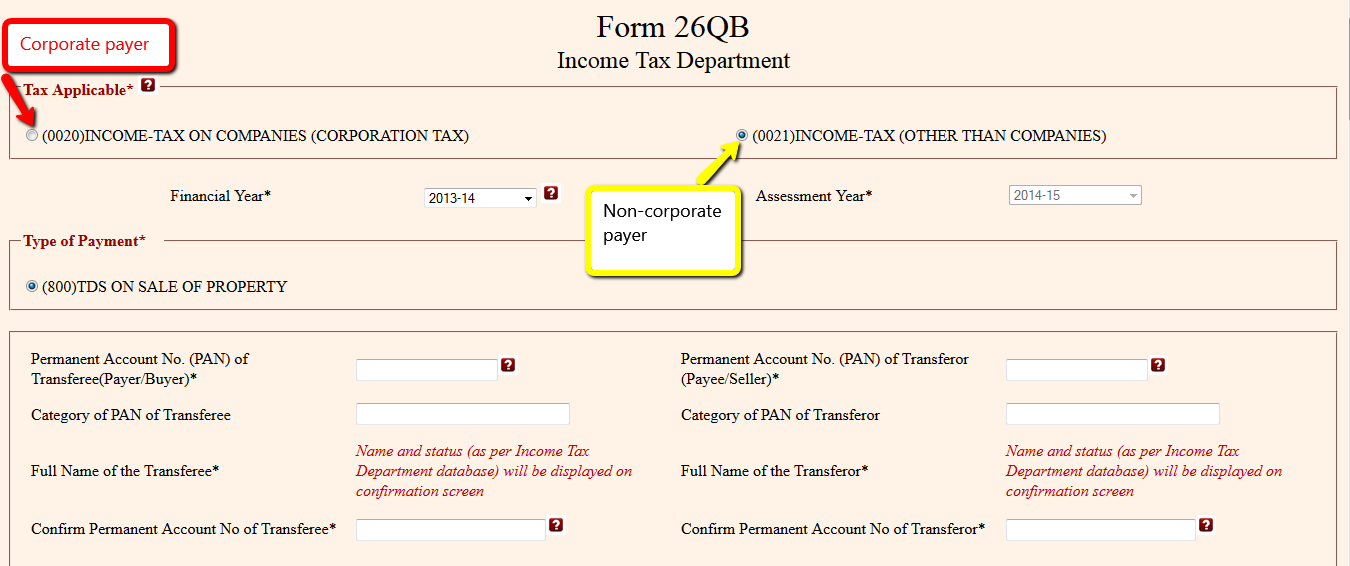

Click on Form 26QB and select 0020 if you are corporate payer and 0021 if you are a non-corporate payer. Fill in all the necessary details.

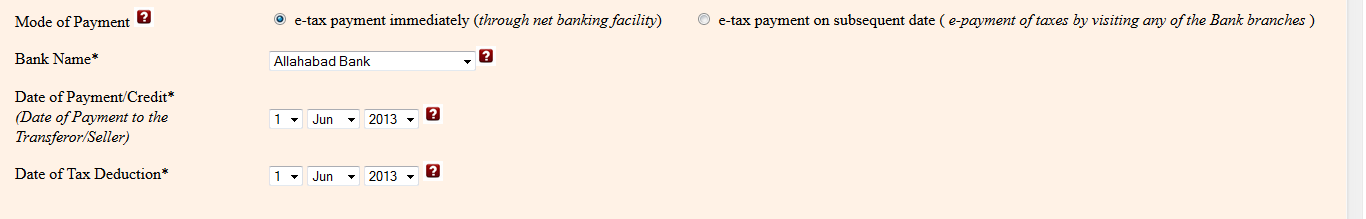

There are 2 modes of payment at the bottom of the page: e-tax payment immediately (through net banking facility) and e-tax payment on subsequent date (e-payment of taxes by visiting any of the Bank branches). Choose the one which you prefer and click on Proceed.

If you choose net-banking, you will be able to login to your bank and pay online. After you have paid, the bank lets you print Challan 280 with a tick on 800 (i.e. payment of TDS on sale of property). Print this out and keep it safely.

If you cannot pay online, an online receipt for Form 26QB with a unique Acknowledgment Number is generated for you. This is valid for 10 days after generation. You can take this to one of the authorized banks along with your cheque. The bank will proceed with the online payment and generate your challan.

Step 2: Generation of Form 16B or Form 26QB

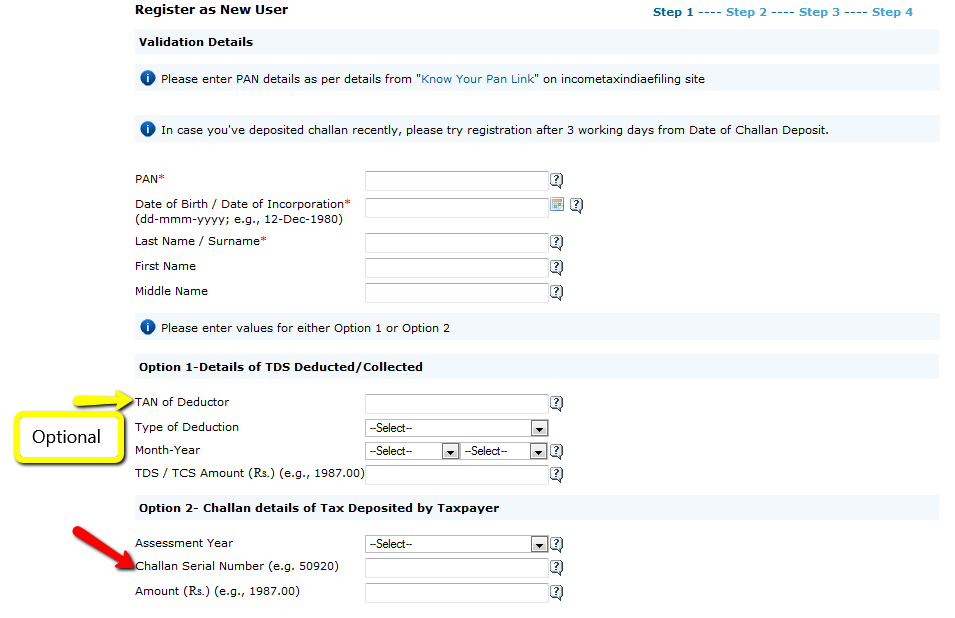

If you are a first-time user, register on TRACES as a Tax Payer with your PAN Card Number and the Challan number registered during payment.

Once you register, whether you are a seller or a buyer, you will be able to obtain your approved Form 16B or Form 26QB. Check your Form 26ASseven days after payment. You will see that your payment is reflected in Part F under “Details of Tax Deducted at Source on Sale of Immoveable Property u/s 194(IA) [For Buyer of Property]”.

This gives you details such as TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgment number (which is the same as the one on your Form 26QB), date of deposit and TDS deposited.

Step 3: Download your Form 26QB or Form 16B

After your payment in Form 26AS has been reflected, login to TRACES. Go to the Download tab at the tab and click on Application for Request of Form 16B. For Form 26QB click on Application for Request of Form 26QB. To finish this process, fill in your 9-digit acknowledgment number and the details in Part F of your Form 26AS. This will generate an application request number and give you an application.

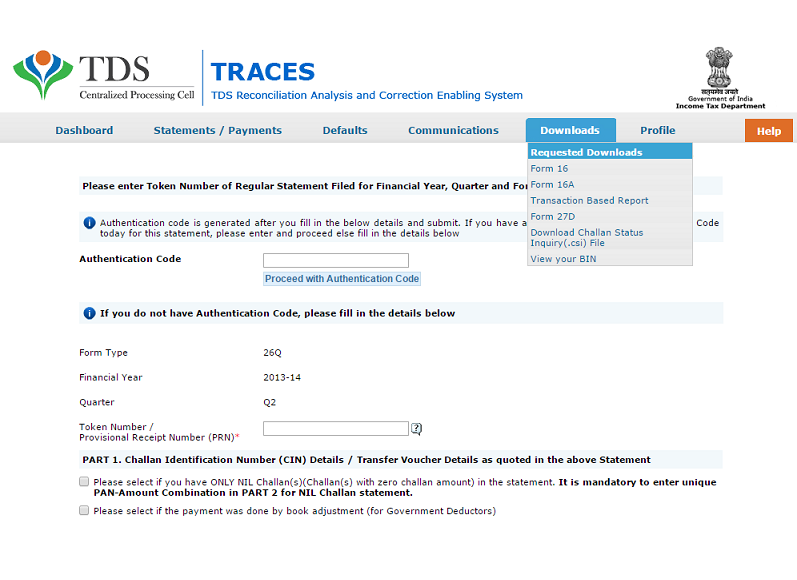

After a few hours your request will be processed. Click on the Downloads tab and select Requested Downloads from the dropdown menu.

You should be able to see that the status of your Form 16B or Form 26QB download request is Available. If status says Submitted wait for a few hours more before repeating the last step. Download the .zip file. The password to open the .zip file is Date of Birth of Deductor (the format is DDMMYYYY). Your form will be available inside the .zip file as a pdf. Print this out.

Thanks for Sharing Nice information with us!!

ReplyDeleteBramhaCorp Develop the best Projects in Kalyani Nagar , get your Best 2 BHK & 3 bhk apartments in kalyani nagar Pune within your budget with best Amenities.

Hi, great blog and it's informative which helps to understand about the

ReplyDeletereal estate and very useful to all.

Shiram southern crest

Sobha Morzaria Grandeur

Godrej Air

Arvind Skylands

Mantri Serenity

Assetz 63 Degree East

Brigade Buena Vista

SOBHA DREAM ACRES

Provident Square

Bhartiya City Nikoo Homes

L&t Realty Raintree Boulevard

DNR Casablanca

The Central Regency

Bhartiya City Nikoo Homes2

Provident Park square

Thanks for the information... I really love your blog posts... Increase your Sales through Top seo companies in Chennai

ReplyDeleteHi,

ReplyDeleteThank you so very much for sharing this nice article. This is a very helpful article and I have learned a lot from this content.

Hope you will share similar articles for the different topic.

Trusted Real Estate Company in Gorakhpur | Real Estate Company in Gorakhpur | best Real Estate Company in Gorakhpur | real estate company gorakhpur

Nice Post, Thanks for sharing

ReplyDeletePrestige High Fields

Lanco Hills

The Valencia

Pranit Galaxy

Sirisha Lotus Grande

Quiescent Heights

Prestige Ivy League

This comment has been removed by the author.

ReplyDeleteAmazing post...Great style of wording...Thanks for sharing.

ReplyDeleteLUNGES VS SQUATS

Nice Blog.

ReplyDeleteProperties in Baner

This post is really nice and informative Get New Launch in Gurgaon - Buy Newly Launched Residential Projects Gurgaon, Apartments/Flats, ATS Group ATS Triumph Sector 104 Gurgaon for sale in Gurgaon Contact at 9212306116 submit your query at www.dwarkaexpresswaynewproject.in

ReplyDeleteYou have given good informatin in this blog. thanks for sharing https://bit.ly/2E91cZU

ReplyDeleteYou have shared amazing information about the properties.If anybody looking to buy property in Pune,Then I would suggest you to invest property in Sopan Baug. Kundan spaces offers luxurious project Eternia with 2 BHK flats in Sopan Baug Pune.

ReplyDeleteThanks for sharing such good information!

ReplyDeleteLooking for a property service in Bangalore such as residential, commercial and more at affordable cost? Then you are at a right place as PropTension provides you with various options to choose from them.Find

property management agency in bangalore

list of property management companies in bangalore

bangalore property management for nris

Real Estate Management in Bangalore

Residential Apartment Management in Bangalore

I recently came across your blog and have been reading along. I thought I would leave my first comment.

ReplyDeleteVisit architectural rendering studio

nice blog,BramhaCorp Provides the best commercial office in Pune with latest and the finest amenities and infrastructure for a truly world-class Business Shops in Bavdhan

ReplyDeletethanks for sharing the information,Best 2 & 3 BHK flats in NIBM Pune , Developed by BramhaCorp with all the amenities and on best Natural location with ease of conveniences flats in NIBM.

ReplyDeleteThanks For Sharing This Nice Information.

ReplyDeleteBoulevard by Bramhacorp Builders provides the new projects in pune And upcoming project in pune And ongoing construction project in pune with Premium office spaces now for sale!

Thanks for sharing a great Information. If anyone looking to invest in real estate project ...more information about projects visit www.gharpravesh.com

ReplyDelete2BHK - 3BHK Flats, Apartment in Pune

Under Construction Flats in Pune

Nice blog and thanks for sharing the information!!

ReplyDeleteProvident Kenworth

Salarpuria Sattva Magnus

Assetz Sun and Sanctum

Thanks for sharing the information with us!!

ReplyDeleteProvident Kenworth

Ramky One Galaxia

Sumadhura Horizon

NCC Urban Gardenia

MPR Urban City

Sri Aditya Athena

Great article with excellent idea i appreciate your post thankyou so much and let keep on sharing your stuffs

ReplyDeleteThanks for the article…

Best Digital Marketing Agency in Chennai

Best SEO Services in Chennai

seo specialist companies in chennai

Brand makers in chennai

Expert logo designers of chennai

Best seo analytics in chennai

leading digital marketing agencies in chennai

Best SEO Services in Chennai

Hii, This is Great Post !

ReplyDeleteThanks for sharing with us!!!!

I would highly appreciate if you guide me through this.

Thanks for the article…

Best Digital Marketing Agency in Chennai

Best SEO Services in Chennai

seo specialist companies in chennai

Brand makers in chennai

Expert logo designers of chennai

Best seo analytics in chennai

leading digital marketing agencies in chennai

Best SEO Services in Chennai

Thank you for sharing this much informations social media agencies in chennai | social media marketing agencies in chennai

ReplyDeleteNice blog and thanks for sharing the post.

ReplyDeletePrestige High Fields

Sark Town Homes

Sri Aditya Athena

Vamsiram West Wood

Nice Blog and Thanks for sharing with us,

ReplyDeletePBEL City

PBEL City Appa Junction

PBEL City Hyderabad

Nice Blog and Thanks for sharing with us,

ReplyDeletePrestige Tranquil

Prestige High Fields

Urbanrise Spring Is In The Air

Spring Is In The Air

Indis Viva City

Nice Blog and Thanks for sharing with us,

ReplyDeletePrestige Tranquil

Prestige High Fields

Urbanrise Spring Is In The Air

Ambience Courtyard

Spring Is In The Air Urbanrise

Aditya Athena

Sark Town Homes

Sri Aditya Athena

Vamsiram West Wood

Provident Kenworth

Nice...I really like your article...I think that you spent more time and effort on your blog...thanks for sharing this good information & i have some information about the Real Estate luxurious projects in Hyderabad, Telangana.

ReplyDeleteThis Project will helpful for those who are looking to buy their Dream Home with low budget..

Thanks for Sharing..!.!

The Botanika

Spring Is In The Air

Sumadhura Horizon

Aditya Athena Hyderabad

Ambience Courtyard Manikonda

Sark Town Homes Shankarpalli

Your selection of topic is very good and also well written. Thanks for sharing. I feel like all your ideas are incredible! Great job!!!

ReplyDeleteI have some information about:

Brigade Citadel

Sri Aditya Athena

Ramky One Harmony

Pooja Magic Breeze

Luxury Park 2

Nice Blog,I feel like all your ideas are incredible! Great job!!!

ReplyDeleteI have some information about:

Pbel City

ASBL Spire

Phoenix Luxury Park 1

Aspire Spaces Ameya

Aspire Ameya

Nice Blog and Thanks for sharing with us,

ReplyDeletePrestige Tranquil Hyderabad

Prestige Tranquil Kokapet

Nice Information...Thanks for sharing with us & I have some Information about Urbanrise Talk of Hyderabad is a new project located in Bachupally, Miyapur. It provides 2,3 & 4 BHK Luxury residences available for sale in affordable prices.

ReplyDeleteUrbanrise

Urbanrise Talk Of Hyderabad

Urbanrise Talk Of Hyderabad Bachupally

Urbanrise Talk Of Hyderabad Miyapur

Urbanrise Talk Of Hyderabad Price

Urbanrise Talk Of Hyderabad Location

Nice Blog and Thanks for sharing with us,

ReplyDeleteUrbanrise Talk Of Hyderabad

Venice City Villas

Nice Blog and Thanks for sharing with us,

ReplyDeleteBrigade Citadel

Epitome Integrated City

Indis Pbel City

VB City

Indis Viva City

Kalpataru Avante

Nice Blog...!! Thank you for sharing this information.,

ReplyDeleteSAS Crown

Sumadhura Olympus

Ambience Courtyard

Thanks for sharing this useful information this information will be very helpful for us regards,

ReplyDeletehmda plots for sale in shamirpet.

Thank you for sharing this.

ReplyDeleteAt Singla Pawan Associates, we've been providing various services since last 25 years. If you need services for your business, we want to hear from you. Call today for consultancy 98141-22754

Chartered Accountants in Chandigarh