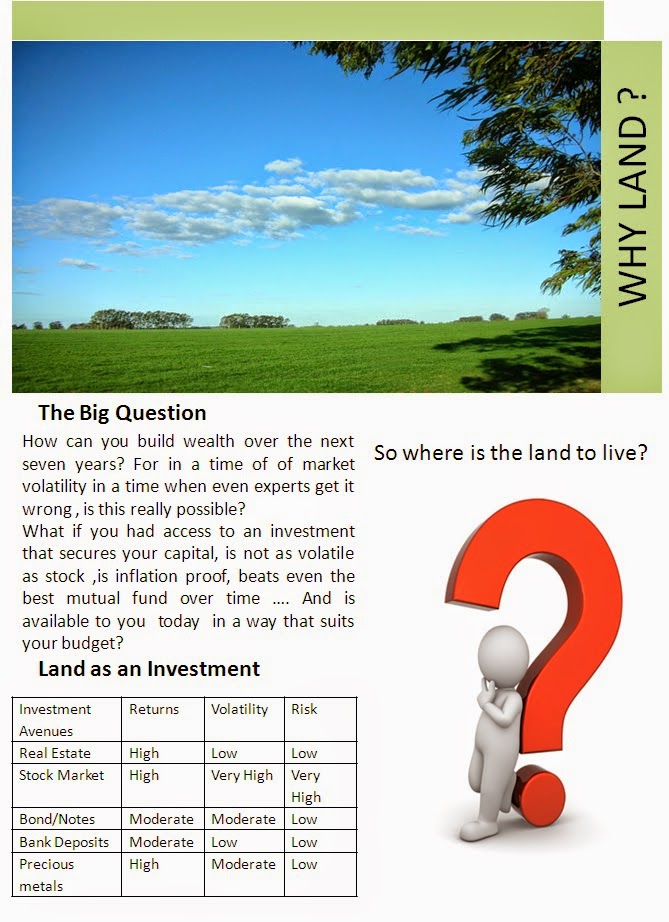

WHY INVEST IN LAND?

"Indian Economy Boom in recent years has brought massive tranformation in Real Estate industry and opened a path to provide professional services in this sector" (this blog is penned by Mr. Deepak Sundrani, An Estate Consultant Based in PUNE, Maharashtra, India.) We work in Pune, Panchgani, Mahabaleshwer, Lonavala, Mumbai & Goa’s premium high ticket price properties, You can contact directly # +91- 9822052388, +91-7498829332, Email: deepaksundrani@thegururealty.com